income tax number malaysia

Employees Withholding Certificate Form 941. You would pay income tax on a gain of 90 per share.

Updated 2021 Tax Reliefs For Ya 2020 And How To File Income Tax In Malaysia Using Lhdn E Filing Iproperty Com My

But you are delinquent on a student loan and have 1000 outstanding.

. You must have an ATM card from the respective bank to proceed with payment and you also need to provide your income tax reference number to complete the transaction. Depending on taxpayer ID number. Top 10 per cent Malaysia vs.

May July September and. D Pay your tax via tele-banking Payment of individual Income Tax and RPGT can be made via tele-banking service only at Maybank Berhad Kawanku Phone Banking 1-300-88-6688. You can efile income tax return on your income from salary house property capital gains business profession and income from other sources.

If you own rental real estate you should be aware of your federal tax responsibilities. The income is deemed as a business sources if maintenance services or support services are comprehensively and actively provided in relation to the real property. Equal-split-adults series income of married couples divided by two.

A number of services have reduced VAT citation needed for instance public. Just upload your form 16 claim your deductions and get your acknowledgment number online. 30062022 15072022 for e-filing 6.

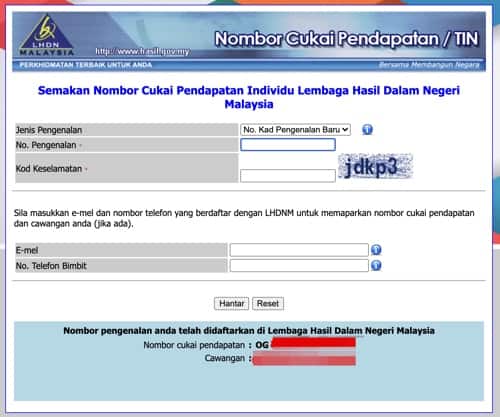

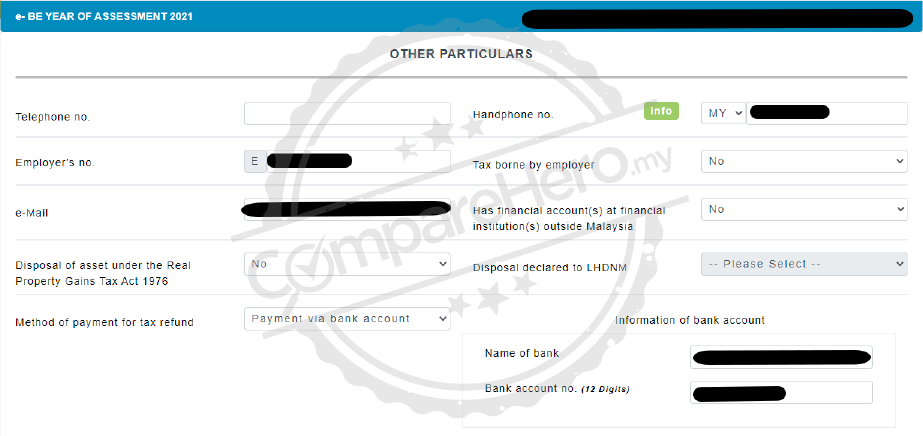

Empty lines of text show the empty string. Malaysia Information on Tax Identification Numbers Updated 2 December 2020 Section I TIN Description Malaysian Income Tax Number ITN or functional equivalent In Malaysia both individuals and entities who are registered taxpayers with. Special Income Remittance Program PKPP For Malaysian Tax Resident With Foreign Sourced Income.

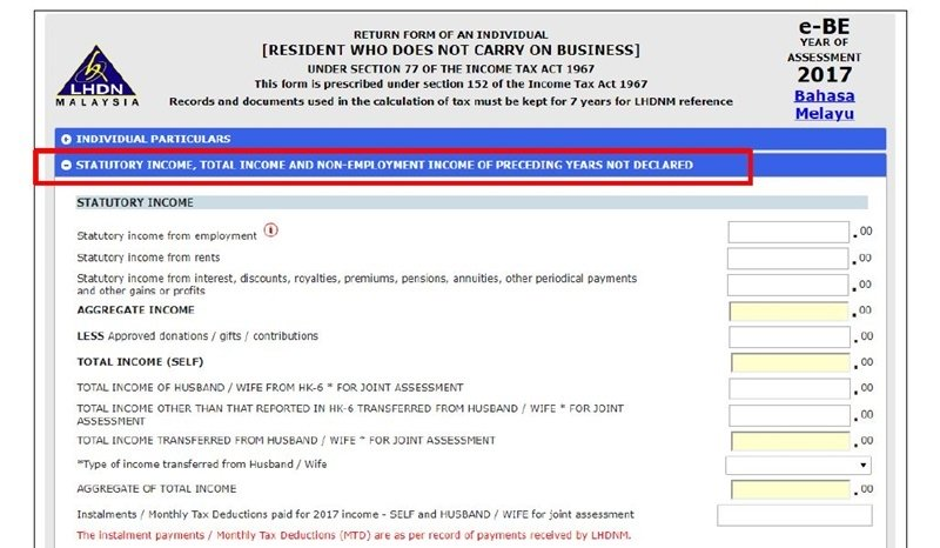

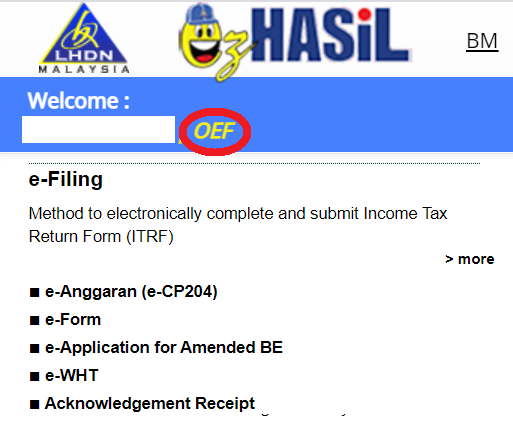

Our suites of tax calculators are built around specific country tax laws and updated annually to provide a dependable tax calculator for your comparison of salaries when looking at new jobs reviewing annual pay. Form P Income tax return for partnership Deadline. For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021 for manual filing and 15 May 2021 via e-Filing.

Capital gains from the sale of shares by a company owning 10 or more is entitled to participation exemption under certain terms. Request for Taxpayer Identification Number TIN and Certification Form 4506-T. Further you can also file TDS returns generate Form-16 use our Tax Calculator software claim HRA check.

By doing so you may receive a refund for some or. Company Tax Deduction 2021. The system is thus based on the taxpayers ability to pay.

Capital gains in the Czech Republic are taxed as income for companies and individuals. In Malaysia income derived from letting of real properties is taxable under paragraph 4a business income or 4d Rental income of the Income Tax Act 1967. If Marks German tax liability on the 13500 is 1500 once converted from EUR the foreign tax credit of 200 will reduce his German liability.

Once you know your income tax number you can pay your taxes online. Company Tax Deduction 2021. Get information on latest national and international events more.

Under the old income tax regime a higher tax exemption limit is available to senior citizens and super senior citizens. The allocation is generally made on the basis of the number. Zero-filled memory area interpreted as a null-terminated string is an empty string.

The grey rectangle that says tax revenue Total. This means that low-income earners are imposed with a lower tax rate compared to those with a higher income. Malaysia Last reviewed 13 June 2022.

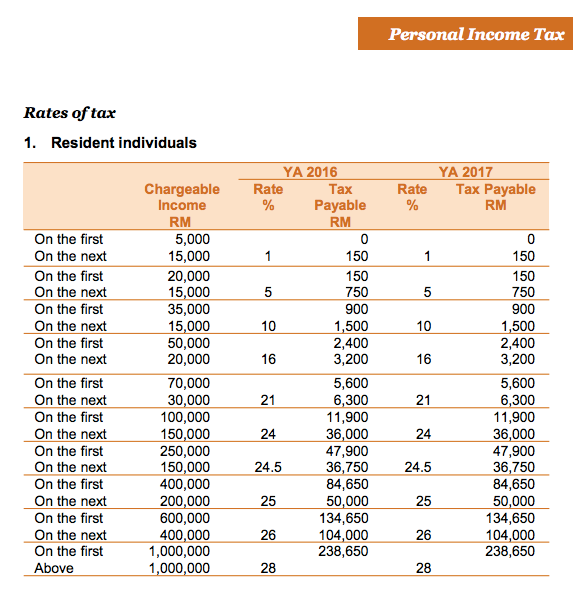

Deadline for Malaysia Income Tax Submission in 2022 for 2021 calendar year Personal Tax Relief 2021. The double tax treaty tells Mark that the UK has the main right to tax the income and that if Germany also wants to tax it then the foreign tax credit method should be used to avoid double tax. It will also send you a notice of its action along with the remaining 500 that was due to you as a tax refund.

Read latest breaking news updates and headlines. The deadline for filing income tax in Malaysia also varies according to what type of form you are filing. Corporate tax in 2010 is 19.

Free Online Salary and Tax Calculators designed specifically to provide Income Tax and Salary deductions for Individuals families and businesses. Since the empty string does not have a standard visual representation outside of formal language theory the number zero is traditionally represented by a single decimal digit 0 instead. You can get your income tax number by registering as a.

Special Income Remittance Program PKPP For Malaysian Tax Resident With Foreign Sourced Income. TOP will deduct 1000 from your tax refund and send it to the correct government agency. The goods and services tax GST is a value-added tax introduced in Malaysia in 2015 which is collected by the Royal Malaysian Customs Department.

The rules are different for property acquired from an estate. Top 10 per cent other countries pre-tax national income. Content Writer 247 Our private AI.

Engine as all of the big players - But without the insane monthly fees and word limits. Heres an example. Further you can also file TDS returns generate Form-16 use our Tax Calculator software claim HRA check.

Form B Income tax return for individual with business income income other than employment income Deadline. Deadline for Malaysia Income Tax Submission in 2022 for 2021 calendar year Personal Tax Relief 2021. The local corporate special tax which is a rate multiplied by the income portion of enterprise tax will be abolished from tax years beginning on or after 1 October 2019 and replaced by the special corporate business tax including a size-based tax regime by the 2019 Tax Reform.

Any payable balance resulting from the annual income tax return must be paid not later than the due date established for filing the return. Request for Transcript of Tax Return Form W-4. An individual is considered a Senior Citizen if an individual crosses the age of 60 years during the financial year.

However under sections 216 2161 217 and 2183 of the Income Tax Act you have the option of filing a Canadian tax return and paying tax on certain types of Canadian-source income using an alternative tax method. You can efile income tax return on your income from salary house property capital gains business profession and income from other sources. Once you know your income tax number you can pay your taxes online.

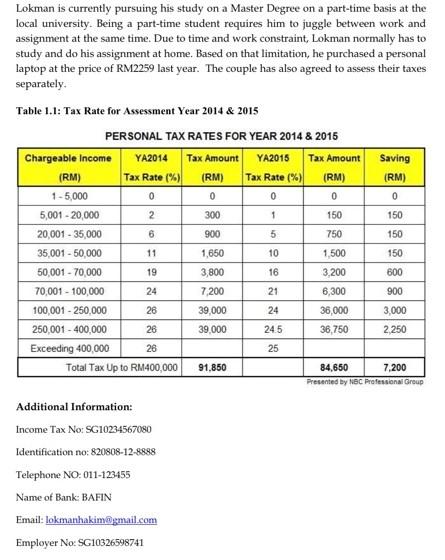

Employers Quarterly Federal Tax Return. You were going to receive a 1500 federal tax refund. Malaysia Personal Income Tax Calculator for YA 2020 Malaysia adopts a progressive income tax rate system.

Over 500000 Words Free. 30042022 15052022 for e-filing 5. Request for Transcript of Tax Return Form W-4.

Imputed rent is included in pre-tax fiscal income and pre-tax national income series. Tool requires no monthly subscription. The Czech income tax rate for an individuals income in 2010 is a flat 15 rate.

Just upload your form 16 claim your deductions and get your acknowledgment number online. Report all rental income on your tax return and deduct the associated expenses from your rental income. Given below are the income tax rates for FY 2021-22 AY 2022-23 and FY 2022-23 under the old tax regime.

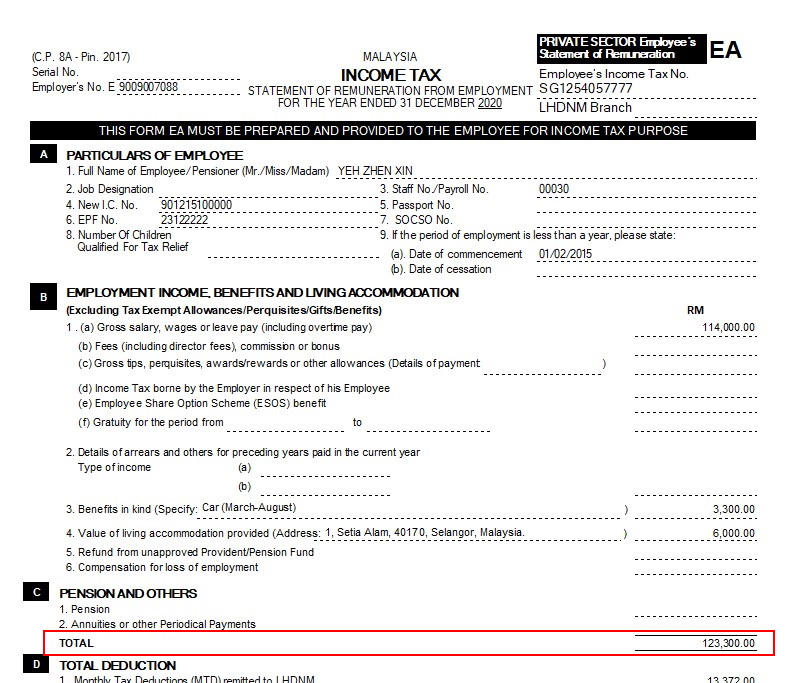

Income tax return for individual who only received employment income Deadline. Alongside Norway Sweden and Croatia. Request for Taxpayer Identification Number TIN and Certification Form 4506-T.

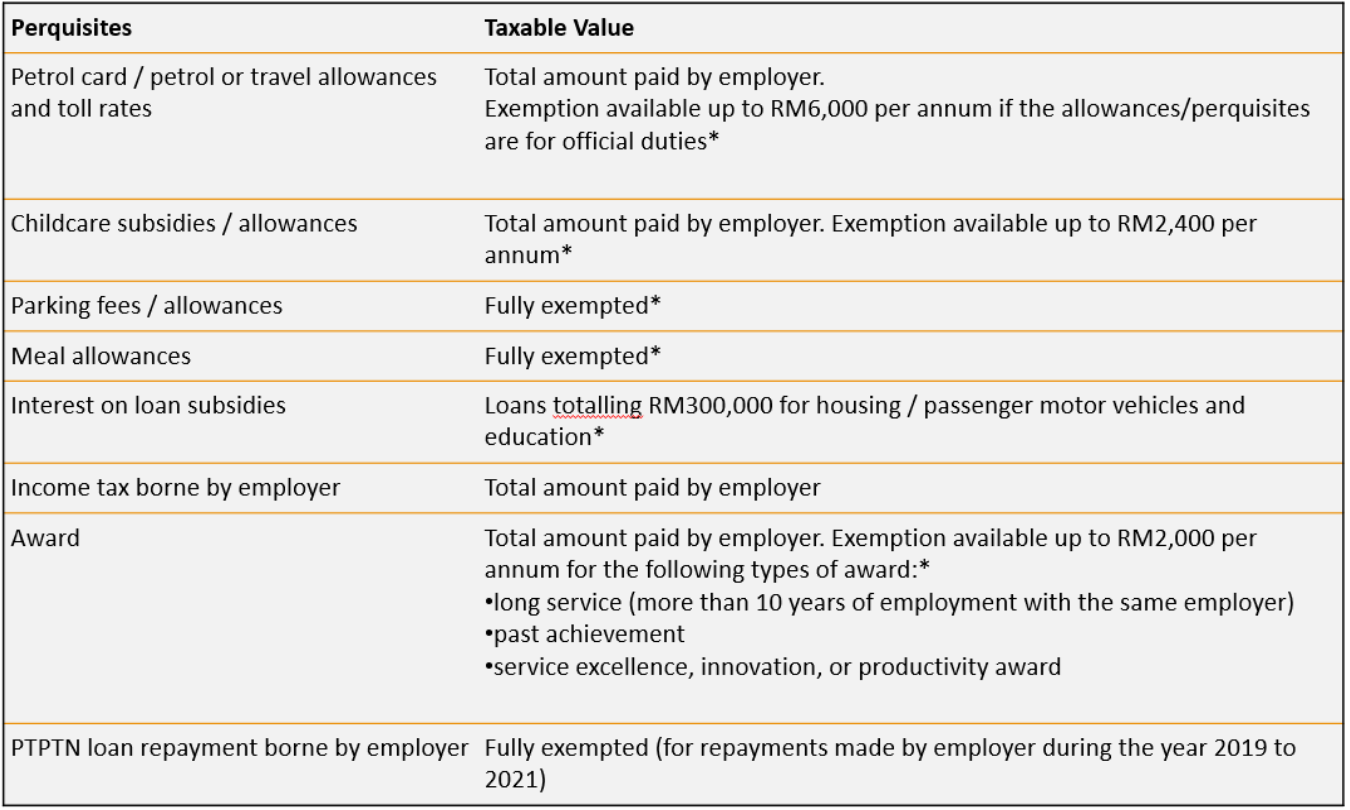

There are also differences between tax exemptions tax reliefs tax rebates and tax deductibles so make.

Malaysia Personal Income Tax Guide 2020 Ya 2019

Tax Dilemma The Income Of Any Person Including A Chegg Com

Income Tax Malaysia A Definitive Guide Funding Societies Malaysia Blog

Filing Income Taxes In Malaysia Mystery Solved By Other Expats Medium

Steps To Check Income Tax Number L Co

Ezhasil E Filing Login Account Pin Number Digital Certificate Application For Organization The Research Files

Semak No Cukai Pendapatan Contoh Nombor Lhdn Number

Just An Ordinary Girl How To Do E Filing For Income Tax Return In Malaysia

Income Tax Malaysia 2022 Basic Guide For Beginners Youtube

Just An Ordinary Girl How To Do E Filing For Income Tax Return In Malaysia

Income Tax Calculator 2021 Malaysia Personal Tax Relief Malaysia Tax Rate

How Do I Register For Tax How Do I Obtain An Income Tax Number Tax Lawyerment Knowledge Base

Pdf The Determinants Of Individual Taxpayers Tax Compliance Behaviour In Peninsular Malaysia

Business Income Tax Malaysia Deadlines For 2021

Pdf The Role Of Income Tax System Structure In Tax Non Compliance Behaviour Among Smes In Yemen

Everything You Need To Know About Running Payroll In Malaysia

How Do I Register For Tax How Do I Obtain An Income Tax Number Tax Lawyerment Knowledge Base

Comments

Post a Comment